amazon flex quarterly taxes

How Much To Put Away For Quarterly Taxes. You may also need to.

How To File Amazon Flex 1099 Taxes The Easy Way

But you can write it off as a deduction on your taxes which means that you wont have to pay taxes on your gas money.

. Those payments are generally due on April 15 June 15 September 15 and January 15 of the following tax year or the next business day due to a. Once your direct deposit is on its way Amazon Flex will send you an email to let you know. Have a look at this resource for more information - 1099 Tax Rate for 2021 and 5 More 1099 Worker Tax Tips.

Driving for Amazon flex can be a good way to earn supplemental income. Need to file your 1099 consultant taxes. We will issue a 1099 form by January 29 to any Amazon Associate who received payments of 600 or more or received payments where taxes were withheld in the previous calendar year unless you are an exempt entity.

Ad We know how valuable your time is. Increase Your Earnings. Knowing your tax write offs can be a good way to keep that income in your pocket.

Businesses such as partnerships S corporations or LLCs that are taxed as partnerships are required to file taxes by March 15 2022. If youre an Amazon seller living in the US then youre probably aware that tax time is coming up. You pay 153 for 2014 SE tax on 9235 of your Net Profit greater than 400.

You must make quarterly estimated tax payments for the current tax year or next year if both of the following apply. I just started gig work in 2021 do I need to file quarterly taxes. You expect to owe at least 1000 in tax for the current tax year after subtracting your withholding and credits.

The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and. Youre suppose to pay quarterly which I will now dropping 27k nearly all at once will mess up my cash flow. You only need to do quarterly taxes if youre going to be above 1000 owed on your yearly return.

With Amazon Flex you work only when you want to. Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone you use to call residents with a locked gate the insurance and down payments on. Or download the Amazon Flex app.

However because Flex is an independent contractor job you have the opportunity to write off business expenses on your tax return. Just claim the 1099 next year. Amazon Flex pays out twice weekly on Tuesdays and Fridays Quarterly Taxes After year 1 as an independent contractor you are expected to pay quarterly estimated taxes.

Amazon income taxes for the quarter ending December 31 2021 were 0612B a 813 increase year-over-year. If you expect to owe taxes of 1000 or more youre usually required to make quarterly estimated tax payments. Now doing this wont help you get the money back per se.

Amazon Flex quartly tax payments. Individuals C corporations sole proprietors single-member LLCs or LLCs taxed as corporations are required to file taxes by. Stay tuned because in this article well walk you through the difference between consultant taxes to employees quarterly taxes self-employment taxes and tax deductions.

Keep in mind that Amazon does not withhold or deduct taxes from you submitting quarterly estimated taxes and annual income tax is ultimately your responsibility as an independent contractor. I know the last thing you want to do is think about taxes more than once a year but paying quarterly taxes will make it so you dont have a huge tax burden at the start of a new year. I did flex full time in 2017 made about 30k and after deductions Ill owe around 27k.

Generally payments to a corporation including a limited liability company LLC that is treated as a C- or S-Corporation do not receive. No matter what your goal is Amazon Flex helps you get there. Get started now to reserve blocks in advance or pick them daily based on your schedule.

Quarterly and Yearly Tax Filing Tips. Gig Economy Masters Course. Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C.

Amazon annual income taxes for 2021 were 4791B a 6734 increase from 2020. With only Flex amount stated youll be well below that number. You expect your withholding and credits to be less than the smaller of.

How To Pay Taxes For Amazon Flex R Amazonflexdrivers Most small time investors are allowed to file their taxes annually on April 15th. Once you calculate what that percentage is for the tax year divide that number by 4 -- and you have your quarterly estimated tax payments. Amazon is without a doubt one of the biggest companies in the world but if youre a.

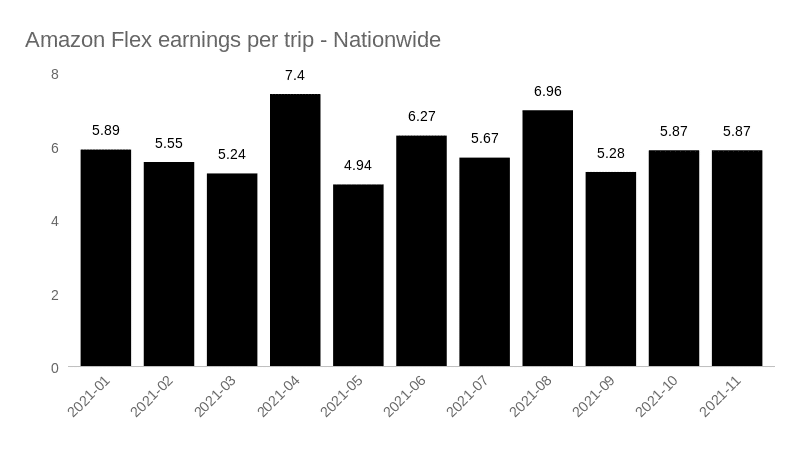

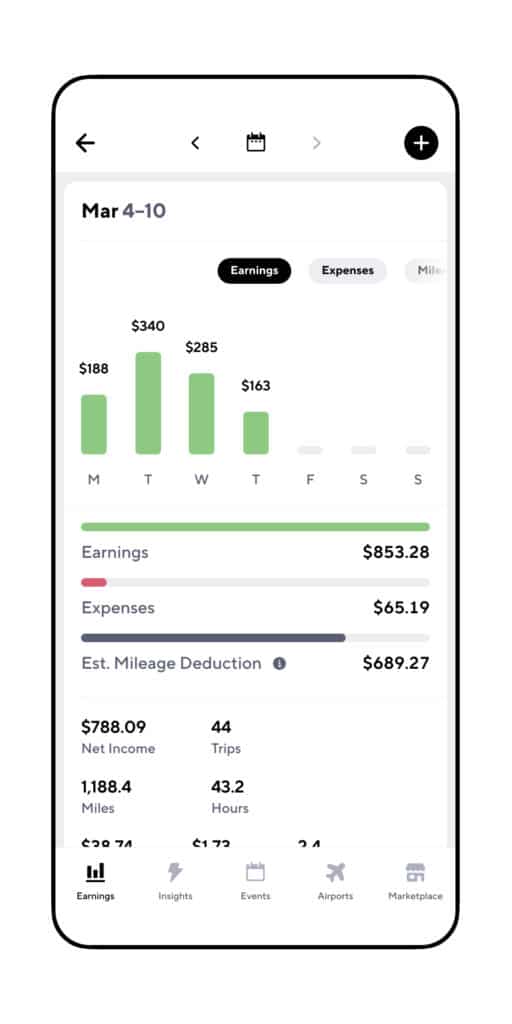

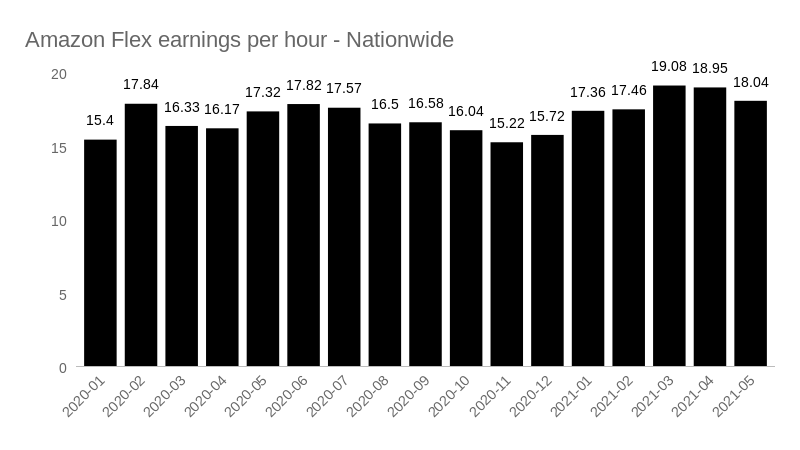

Finally consider making quarterly tax payments. The general rule of thumb is to put away 30-35 of your Adjusted Gross Income income reduced by tax write-offs for taxes. Most drivers earn 18-25 an hour.

Amazon income taxes for the twelve months ending December 31 2021 were 4791B a 6734 increase year-over-year. Actual earnings will depend on your location any tips you receive how long it takes you. If you have a lot more 1099 side work you can add to your estimated quarterly due.

Because working for Amazon Flex makes you an independent contractor youll be responsible for withholding money for your taxes.

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Amazon Flex Drivers Ask Amazon To Help With High Gas Costs Protocol

How To File Amazon Flex 1099 Taxes The Easy Way

Earnings Recap Amazon Flex Driver Pay 2021 Gridwise

![]()

How Quickly Do I Get Paid Through Amazon Flex Money Pixels

How To File Amazon Flex 1099 Taxes The Easy Way

I Was An Amazon Delivery Driver What It S Like To Work In The Tech Giant S Citizen Package Brigade Geekwire

Amazon Flex Driver How To File Your Taxes In 2022 1099 Nec Youtube

How Many Packages Does Amazon Flex Give You

How Much Do Amazon Flex Drivers Make Gridwise

How To Do Taxes For Amazon Flex Youtube

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

How Much Do Amazon Flex Drivers Make Gridwise

How Amazon Build One Day Shipping Digital Laoban

How Much Do Amazon Flex Drivers Make Gridwise

Tax Guide For Self Employed Amazon Flex Drivers Goselfemployed Co